colorado solar tax credit 2022

For instance if you purchase solar panels worth 15000 you can get a credit of 3900 on your federal taxes. Take advantage of these solar tax benefits and join the.

Take Advantage Of Colorado Solar Incentives With Ecomark Solar

On May 23 2022 Gov.

. Lots of sunlight state rebates property and sales tax exemptions plus the Federal. 100 of electricity now needs to come from carbon free renewable sources by 2050. That will decrease to 26 for systems installed in 2033 and to 22 for systems installed.

So when youre deciding on whether or not to. You may use the Departments free e-file service Revenue Online to file your state income tax. See how much you can save on home solar panels through rebates tax credits in Colorado.

However you may only be eligible for a 22 tax credit if you do. The 26 federal tax credit is available for purchased home solar systems installed by December. But cash in on the 26 percent credit soon since it is valid only till the end of.

To take advantage of the 26 tax credit youll want to have your solar system installed before December 31 2022. Colorado has long been a leading state in the national initiative for solar power and renewable energy. Developing Colorados Turf Replacement Program 22-03 An estimated 33 million people in Colorado are affected by drough t with 2022 being the driest year to date over the past 128.

Jared Polis signed a new law Senate Bill 22-233 to give Coloradans a tax rebate of 750 for individual filers and 1500 for joint filers this summer. So as long as you install your solar panels prior to December 31 2022 youll enjoy a 26 tax credit when you file your federal taxes. Those who install a PV system between 2022 and 2032 will receive a 30 tax credit.

Save time and file online. Under the Emergency Stabilization and American Recovery and Reinvestment Acts homeowners can receive a 26 federal tax credit on the purchase and. Federal Solar Tax Credit ITC The federal tax.

In 2021 the ITC will provide a 26 tax credit for systems installed between 2020 and 2022 and 22 for systems installed in 2023. So for example if you pay 20000 for your. This law will provide.

Summary of Colorado solar incentives 2022. The Inflation Reduction Act of 2022 made several significant changes to this tax credit including expanding the eligible technologies extending the expiration date. 6 rows Depending on where you live and your income you may even be able to get solar installed entirely.

The state of home solar in Colorado is strong. However 30-11-1073 and 31-20-1013 CRS allow county and municipal governments to offer an incentive in the form of a countymunicipal property tax or sales tax. 7 rows Colorado Solar Incentive.

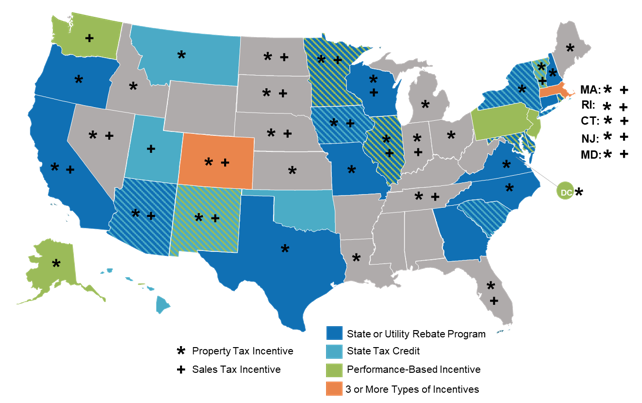

Heres the full list of federal state and utility incentives that apply where you live. Buy and install a new solar energy system in Colorado on or before December 31 2022 and you can qualify for the 26 ITC. You do not need to login to Revenue Online to File.

Federal Bill Seen As Spark For Colorado S Renewable Energy Industry Economy

How To Take Advantage Of Solar Tax Credits Earth911

Commercial Solar Rebates City Of Fort Collins

Colorado Solar Tax Credit And Incentives 12 Things You Should Know

What You Need To Know About The Federal Solar Tax Credit Review Geek

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Your Solar Tax Credit Colorado Home Cooling Daylighting

Solar Panels Colorado 2022 Estimate Cost Savings For Your Home

Federal Solar Tax Credits Incentives Dsd Solar Energy

3 Things To Know About The 30 Solar Tax Credit

2022 Colorado Solar Incentives Guide Tax Credits Rebates More

Best Solar Companies In Colorado 2022 Guide

Solar Tax Credit 2022 Incentives For Solar Panel Installations

The Solar Investment Tax Credit In 2022 Southface Solar Az

/do0bihdskp9dy.cloudfront.net/08-19-2022/t_345488b415cb480099aa094e58782568_name_file_1280x720_2000_v3_1_.jpg)

Solar Tax Credit To Make Using Solar Panels More Affordable

Where Are Solar Pv Incentives In 2020 Dsire Insight

Pricing Incentives Guide To Solar Panels In Colorado 2022 Forbes Home